The number of smoke detectors in Spain was 1.27 million in 2022.

A TECNIFUEGO study shows that 1.27 million smoke detectors were installed in Spain in 2022. TECNIFUEGO is the Spanish Association of Fire Protection Companies. There has been a significant increase in logistics warehouse projects over the past two years, promoting detection technologies like intake and linear detection. Similarly, there was a rise in warning device sales and an uptick in the installation of alarm transmission equipment to reception centres.

According to the TECNIFUEGO study, there has been no increase in the installation of point detectors since 2018. In 2022, it is projected that demand will reach 1.27 million, representing a slight increase from the 1.26 million reported in 2018. Furthermore, there was a bounce back in 2021 after a decrease in 2020.

The Detection Committee's coordinator, Lluís Marín, examined the study's most notable findings: "The lock downs created uncertainty, which was further affected by a lack of components over the past year. At the same time, raw material costs surged significantly.” Indeed, the scarcity of materials resulting from production line shutdowns and challenges in importing for various reasons caused significant market stress in 2022. Price stability proved to be a challenge as a result.

Over the past two years, there has been considerable growth in logistics warehouse projects for detection technologies like intake and linear detection. Similarly, there has been a significant uptick in warning device sales, undoubtedly fuelled by the mandate to install both visual and auditory alarm signals, as outlined in the CTE [Technical Code for Building Construction in Spain] and RIPCI [fire protection installation regulations].

Alarm transmission equipment

It is worth mentioning that there has been a significant increase in the installation of alarm transmission equipment to fire alarm reception centres. We should certainly celebrate this trend, which we hope will continue to grow, as it will lead to improved protection and maintenance of effective and auditable systems. There is a growing need for innovative technologies to manage detection and alarm systems throughout their lifespan. These systems promise enhanced productivity, service quality, and competitiveness throughout their lifespan.

Overall, revenue is expected to have increased from the previous year, but there was a drop in profit margins. Project sizes were also, on average, smaller.

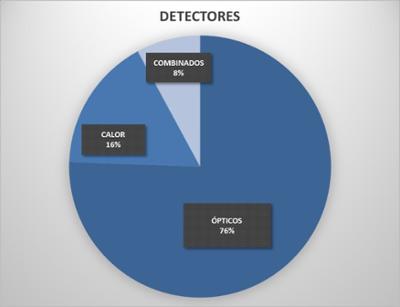

As anticipated, there was no change in choosing point detection technologies, with 76% of all detectors currently installed being optical detectors and 16% are heat detectors.

Also noteworthy is the continuing decline of conventional systems in relation to analogue systems. Although this trend is no longer as pronounced, it still makes sense considering the market's price evolution and the benefits provided by analogue-directional systems.

In line with the market trend in fire detection systems, permits for non-residential building constructions rebounded in 2021 and remained steady in 2022 according to the Spanish office of national statistics.